Foreign Exchange Deeper Dive

Back in June, I wrote about credit card foreign exchange rates and concluded that no payment network consistently or substantially provides better rates than another. I intended for that research to be the last time I gave this topic any thought.

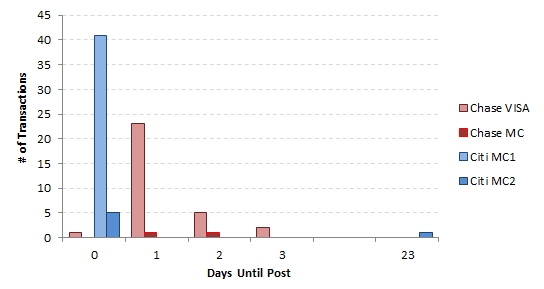

As I tried to wrap up the materials for that article, however, I noticed something about transaction dates vs. post dates on my purchases:

- Nearly all of my Citi (MasterCard) transactions posted on the same days the purchases were made, but most of my Chase (MasterCard and VISA) transactions took more time to post

- There was a purchase that took over 3 weeks to post

Most intriguingly, that oddball purchase posted at an amount quite a bit less than I expected. It turned out that the Euro had weakened in my favor during those three weeks. This got me thinking: how much does the promptness of my credit card process affect how much I end up paying? For example, if the Dollar is strengthening against the foreign currency used, am I better off using a card that takes more time to settle charges?

METHODOLOGY

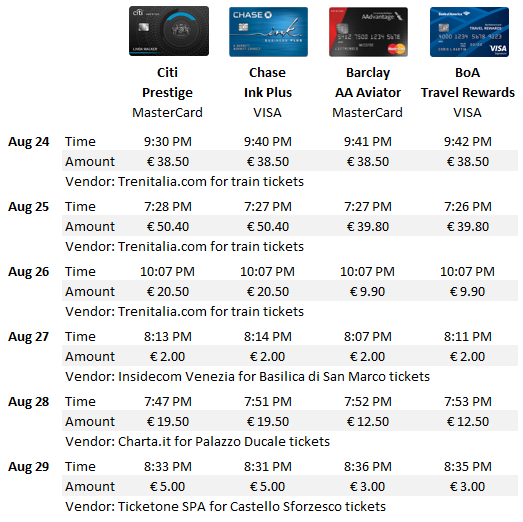

I wanted to make “simultaneous” purchases using VISA and MasterCard to experiment with exchange rate and post timing. To eliminate potential differences in vendor processing or rounding, these purchases should ideally be from the same vendor and of the same amounts. Further, I was curious whether the issuing bank made any difference in addition to the payment network.

Fortunately, we were visiting Italy with my wife’s parents, and happened to need four tickets to several trains and attractions. I picked out two MasterCards and two VISAs from four distinct issuing banks (note: would’ve loved to include Amex in this analysis, but its statements do not distinguish transaction vs. post dates). I purchased one set of tickets per day for six consecutive days, making a separate booking for each adult in our group. All four transactions each day were made within minutes from one another to minimize any discrepancy in lag. Lastly, just in case a few minutes would’ve introduced any bias, I alternated the order of cards from day to day (i.e. I used Citi Prestige first on 8/24 and last on 8/25).

It was a heck lot of work to make all these separate bookings while making sure everyone was seated together on the same trains! I hope you all at least find this experiment amusing.

All of these purchases were made at night Pacific Time, which was early the next morning in Italy. The official “transaction dates” on record are apparently Central Time for Citi (i.e. the next day’s date is used when the purchase was made after 10PM my time) and Eastern Time for Chase, Barclay, and Bank of America. I had previously thought that transaction dates reflected the date/time local to the merchant, but that wasn’t the case.

In any event, now I had six sets of four purchases that were as identical as I could make them. If both payment networks and all four banks were made equal, I should see these charges posting in identical patterns (spoiler alert… that’s not the case).

THE LAG

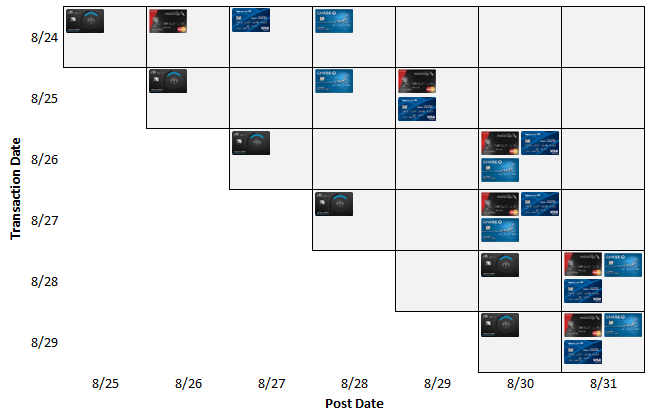

Over the next week and half, I religiously logged onto my bank accounts each day and looked for payments posting. The official post date lags are illustrated below. Each set of purchases is listed on one row, and the columns indicated the post timing. Cards farther on the right took longer to post after purchase.

Five of my six Citi transactions posted on the very first days possible (given my purchase timing being late at night on the West Coast, I assumed that the next day was the soonest they could feasibly be processed). This was impressive, considering that everything else lagged 2-3 days behind. On the other hand, there was no clear winner or loser among the other three cards, since two-thirds of the transactions had identical post dates.

The unintuitive aspect is that the “post” date is not necessarily when a charge becomes posted to the credit card account. For example, my Citi purchase that “posted” on 8/25 was visible when I logged in on 8/26, but the one “posted” on 8/26 did not show up until 8/30. Similarly, despite all my Chase purchases “posting” in August, I did not see four of them until September. Furthermore, my Barclay purchase with a 8/29 post date showed up before my Citi purchase with a 8/26 post date. What’s going on???

I’m guessing that there is an additional lag between when the payment network confirms the transaction and when the issuing bank processes the charge to be reflected on the card. It’s quite possible that the banks have a certain degree of flexibility in defining what the “post date” is, and I may not be comparing apples to apples here. From my perspective as an end user, though, Barclay (MasterCard) had the fastest overall process, beating Chase (VISA) the slowest by 1-3 days.

OFFICIAL EXCHANGE RATES

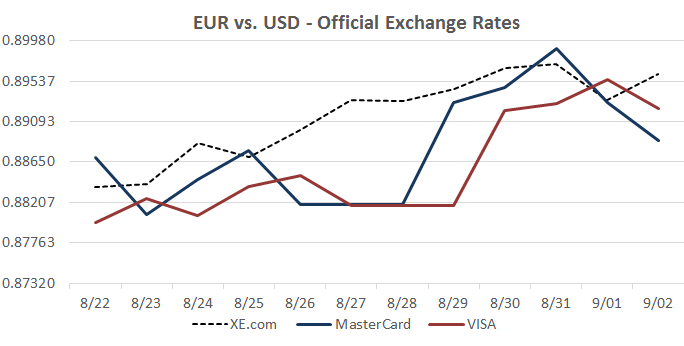

VISA and MasterCard both publish their exchange rates online:

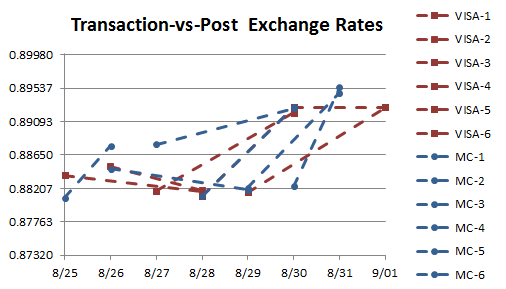

Note that both sets of rates are different from – and usually lower than – rates published on XE.com.

Many bloggers have written about these online tools, usually pointing to a specific example like 8/31 to show that VISA’s exchange rates can be worse than MasterCard’s. Turns out this may not be a meaningful comparison. Notice how the red curve appears shifted to the right from the blue curve by a day? Could they be dating things differently?

EXCHANGE RATES IN PENDING

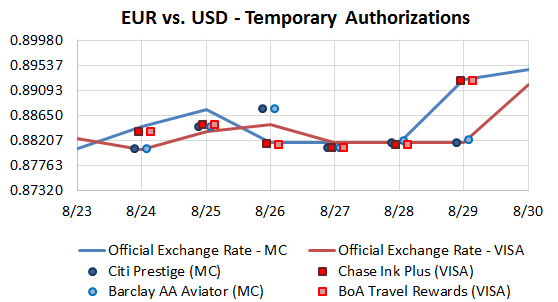

Seconds after me clicking the “pay” button on the merchant website, the pending transactions posted on my online accounts with tentative transaction amounts in USD. Nearly all of the amounts were going to change, but it was intriguing to look at how the implied exchange rates (the dots) compared to the published rates (the lines).

The first thing to notice is that the dots do not fall on the lines, seemingly to indicate a total chaos where transactions do not follow published rates. With closer examination, though, there is actually a pattern.

All the pending VISA transactions reflected the published rates on the next day – i.e. my purchases on 8/25 agreed with VISA’s published rates for 8/26. This made sense since all my purchases were at night on the West Coast, VISA may have regarded them as taking place early morning on the next day.

The MasterCard side of the story is more confusing – the transactions reflected published rates of the previous day! That is, my purchases late on 8/25 (when MasterCard’s official rates for 8/25 had become available) went into pending with the published rates from 8/24. Not sure how this made any sense.

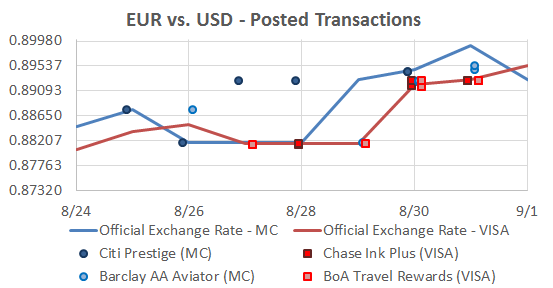

EXCHANGE RATES POSTED

Once the charges formally posted to the accounts, I found that both Chase and Bank of America VISA transactions adhered precisely to the published rates. They may have taken longer to post than their MasterCard counterparts, but I walk away from this exercise with the confidence that I can “audit” a posted foreign transaction by comparing it to the published rates on the VISA website.

On the other hand, I have no idea how to interpret the MasterCard results. 8/27 and 8/28 were a weekend so the two Citi data points may have reflected the settlement rate on the following Monday. However, what is the reason for the Citi and the Barclay data points on 8/26 to differ? I suspect that either the banks were given the liberty to decide how to define their own post dates inconsistent with MasterCard’s processing, or that multiple transactions posting on the same day can receive different rates.

For a different visualization between pending and post amounts, I also plotted the changes in implied exchange rates. All but one MasterCard transactions saw improving rates (i.e. posted amount in USD was lower than the pending amount), whereas VISA was more evenly divided between increases and decreases.

I found this counter-intuitive at first. During the week of experiment, the Dollar grew stronger against the Euro (i.e. you get more Euro per Dollar). Since VISA took (slightly) longer to post, I’d have expected the VISA transactions to have caught the upward trend to a greater extent. The reason for this observation has perhaps to do with how pending MasterCard transactions reflected the more outdated information, which suppressed the perceived rates in a few of the cases, and therefore had more room for improvement.

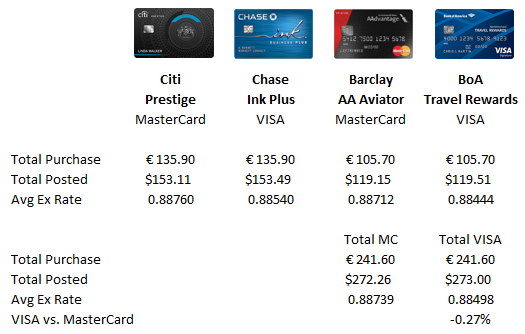

FINAL TALLY

Adding together my 24 purchases on Italian websites, I spent exactly €241.60 between the two MasterCard cards, and €241.60 between the two VISA cards. After they posted to my statements, I owe $272.26 in the MasterCard accounts and $273.00 in the VISA accounts. In this round of foreign exchange rate experiment, MasterCard “won” again with a 74-cent advantage, or 0.27%.

CONCLUSIONS

Ideally, we would have a tool telling us which credit card has the best exchange rate on a given day. Doctor of Credit wrote about an app promising to do this, which unfortunately fails to deliver at the most basic level. Realistically, though, this task is far from possible because:

- At the time of purchase, we do not know when it will be settled

- Unless the currency in question is pegged to USD (in which case we have seen VISA, MasterCard, and Amex coming in neck to neck), it’s impossible to predict the exchange rate 2-4 days into the future. In fact, if you can find a way to do that, you wouldn’t bother with gaming credit cards anyway

- MasterCard’s published rates are often not representative of what we actually get on our statements

From my analyses, MasterCard appears to have a slight edge on the average exchange rates, while VISA’s longer settlement lag may favorably bump a charge or two to the next statement. At the end of the day, however, all these differences are too small to worry about. When deciding what to swipe abroad, I will continue to prioritize the best reward structure among cards that have no foreign transaction fees.

Wow great analysis and conclusion You’ve gained a follower. Good work!

Thanks!

It is the merchant (acquirer) who delays a transaction from posting. This is totally not up to the issuer (Chase).

So every merchant just all happen to single out Chase, among similar/identical purchases, to delay?

Much more than the card issuing bank and the branding association go into posting a transaction. Or better yet, they are the least involved.

Care to offer a theory on what I saw? The experiment was designed specifically to eliminate any differences outside of credit cards, and yet there were gaps in lag.

A transaction can actually be settled and posted in the interchange (i. e. clearing house) before your issuing bank will show it as posted in your online banking activity. In other words, while a purchase shows as pending in your online banking activity, it might have been settled and posted by the interchange a few days ago already.

Great post!

0.26% is clearly dwarfed by any rewards structure difference but makes a great tiebreaker and can add up for large purchases.

Definitely.

I would think that it’s quite rare that anyone values a VISA and a MC’s rewards quite the same, but it’s possible (ie between UR and TY points for someone mainly interested in Singapore miles).

A transaction can actually be settled and posted in the interchange (i. e. clearing house) before your issuing bank will show it as posted in your online banking activity. In other words, while a purchase shows as pending in your online banking activity, it might have been settled and posted by the interchange a few days ago already.

Peter you need to get back to blogging! Your level of rigor and analysis is monumentally better than everyone else!