Foreign Exchange Rates – VISA vs. MasterCard vs. Amex

There is a widely circulated belief that VISA’s foreign currency conversion rates are 1% less favorable than MasterCard’s. Even in the absence of an explicit foreign transaction fee, this “hidden surcharge” may cost VISA’s customers more. The assertion is that a savvy consumer should use a MasterCard abroad.

This topic received a lot of attention recently:

- In February, View From the Wing titled a post Does Visa Shortchange You 1% on Foreign Currency Conversion? With only three data points, he concluded that MasterCard had a 1% advantage over VISA, and VISA tied with American Express

- A day later, Doctor of Credit wrote What Foreign Currency Exchange Rate Do Credit Card Issuers Use? It was a fairly technical article on how payment networks determined their exchange rates, and looked into some examples of currencies where VISA and MasterCard had an advantage over each other. He mentioned in passing that the alleged 1% difference may be a thing of the past

- In May, One Mile At A Time did another comparison between VISA and MasterCard using their respective currency conversion tools. The approach was similar to DoC’s, but the post was titled with the strongest wording yet: Why You Should Use A MasterCard When Traveling Internationally

- In the comments below each post were some readers noting how they had switched to exclusively use MasterCard abroad, reaffirming the MasterCard advantage on exchange rates

A 1% difference would be a big deal – it’s as much as the gap between cash and credit card just a few years ago. Does this “hidden surcharge” really exist, though, or is it an outdated phenomenon as DoC noted? I have a lot of respect for Gary and Lucky, and love their blogs. However, in this case they both made a definitive claim based on very limited information. I was intrigued by this topic, but not ready to accept their conclusion with the level of details presented.

I set out to collect my own data.

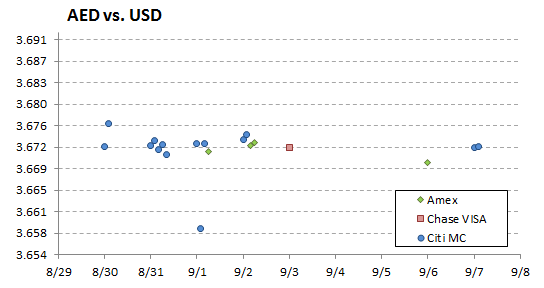

Immediately upon reading Gary’s post, I looked at my own foreign purchases last year. My family traveled through the UAE last summer and casually switched between a few credit cards. The resulting exchange rates are illustrated in the chart below.

The spread across the Y-axis is 1%, and the gap between the dotted lines is 0.1%

For us consumers, higher = better.

The exchange rate was overwhelmingly stable, which made sense since the dirham was pegged to our dollar. The dip on September 1 was due to rounding on a 87-cent bottle of water. Amex and VISA, which I did not use much, appeared a tiny bit less favorable than MC.

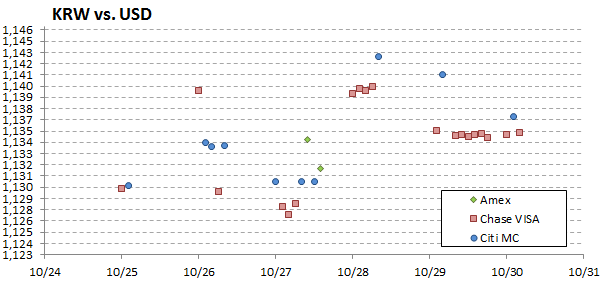

Later in the year, we visited South Korea and used credit cards more frequently. Looking at the Korean Won was interesting because the exchange rate fluctuated more than 1% within that week. MC gave me better rates than VISA for all but one transaction, which I assume was influenced by a delayed post date. Summarized by day, MC’s advantage over VISA went as high as 0.3%, but was usually less than 0.2%. There were only two data points on Amex, both of which beat MC by more than 0.2%.

The gap between the dotted lines is 0.1%

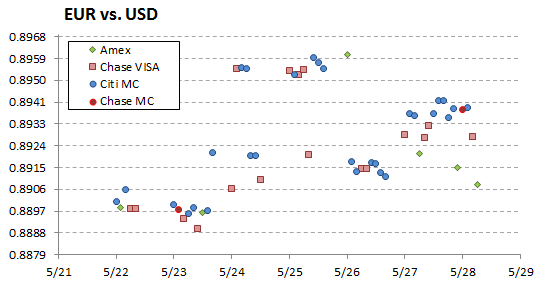

Concurrent to these findings, I came across a comment asserting that VISA’s 1% “hidden surcharge” existed in Europe but not as much in Asia. No explanation was given, but the Asia part was consistent with my observations. I itched to know if there was any truth to the other part. Fortunately, we had an upcoming vacation in Europe. I was excited to experiment with this opportunity – I’d use each type of card everyday for a consecutive period. I brought Citi Prestige (MC), Chase Hyatt (VISA), and Amex SPG Business. For an additional measure, I also brought Chase IHG (MC), to see if the issuing bank made a difference on top of the payment network.

Amex was challenging because not every establishment accepted it. Chase IHG was even harder because it had no chip, rendering it impossible to use in most places. However, I was able to make a minimum of 2-3 purchases per day using each of Citi Prestige and Chase Hyatt, the main focus of my experiment. I compiled the data as follows.

In Belgium and France, my MC and VISA exchange rates for the Euro aligned quite closely. The “MC advantage” ranged from 0.0% to 0.2%. An exception was found when I bought some museums tickets online, several weeks prior to the trip, and found VISA giving me a 0.2% better rate than MC. Amex aligned very closely with MC for the first few days of the trip, but then fluctuated up and down as far as a 0.5% deviation.

The gap between the dotted lines is 0.1%

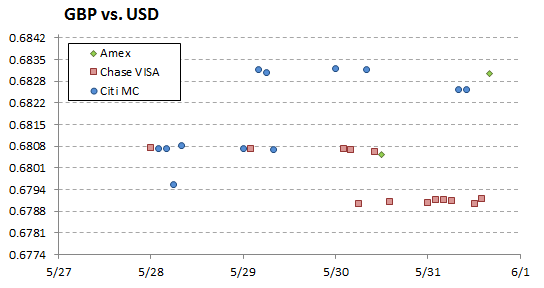

Lastly, we visited the United Kingdom, where I found the highest spread between MC and VISA. They started out almost identical, but diverted strangely: the exchange rate improved with MC, but simultaneously deteriorated with VISA. At its peak, the “MC advantage” reached 0.5%.

The gap between the dotted lines is 0.1%

BOTTOM LINE

From my experience with ~150 transactions across four foreign currencies, no payment network consistently provided better exchange rates than others. MasterCard was directionally more favorable than VISA most of the time, but the difference was far lower than the rumored 1%. While I wouldn’t doubt anyone who have witnessed worse from time to time, the spread in my experience never exceeded 0.5% on any day, and averaged to about 0.1%.

It’s not for me to say whether 0.1% is significant to you. However, many of us value the reward structure between any two credit cards (i.e. 2x Ultimate Reward points versus 2x Thankyou points on dining) more widely apart than that. As such, when I pack my wallet for international trips, this exchange rate issue will not be on the top of my mind.

As for Amex, its limited acceptance abroad makes it unlikely the primary card of choice on an international trip. However, when the moment calls for an Amex, know that it may give you a slightly better or worse exchange rate, just like all the other cards in your wallet.

Data! May be useful to take it one step further to see if the differences are statistically significant, which I doubt.

If I understand this correctly, looking at the EUR vs USD chart out of $1K spending the difference would be only $7.1, less for most data points. I’m not sure about the statistical significance, but it is not wallet-significant for most, especially factoring the difference in card benefits overall, i.e. using a 2% cashback vs 1% card, or using a card to meet minimum spend, or one that offers purchase protection.

Thank you for the great data points Peter!

NoonRadar – I would expect roughly a $1 difference (0.1%), since on most days the red squares (VISA) ran very close to the blue circles (MC).

Great suggestion Natalie. I thought about it briefly but wasn’t sure I knew the correct distribution and test to throw this data against… so I took the easy way out. Will try harder next time.

1. American Express offers the best foreign conversion rate and is widely acceptied here in Brazil

2. On Sunday 26/Jan/2020 I did a split purchase of $100.80 reais ( $50.40 Visa Chase Sapphire preferred/ $50.40 American Express Delta gold )

Visa charge me $12,10 and American Express $12,04 a 6¢ difference both in US Dollars

3. Also I noticed that American Express rounds down, for example if the rate is 12.1698 I will be charge 12.16 Visa never does this and today 26/Jan/2020 I used my Avianca visa and was charged $12,47 US dollars and the current $53,05 reais=12,0076 even rounding up that’s 46¢

Making any points worthless!

4. American Express also never charges a foreign conversion fee which is different from a transaction fee also the exchange rate matches or is even a bit better then XE live currency conversion web site.

There are businesses here ( Mostly Restuarents) in Brazil that charge a foreign conversion fee ( Around 6.99%) even if you choose the local currency you still pay! Cielo a payment processor herr is one of the worst offenders.

I think may be it is not that much statistically significant.

UAE currency is pegged to USD, that`s why you see the smallest gap. A few other currencies (HKD, for example) will yield the similar result. Those should not be used as a data point, however.

I actually think of it this way – when the exchange rate is stable, the payment networks don’t make a difference at all. To me, that’s a data point against the theory that VISA builds a margin into their exchange rate.

Thank you for this thorough piece. I just received my UNITED visa card and noticed after analyzing charges to a foreign partner that I was being billed $40-50 USD per $4,500. USD over the daily WSJ rate even though VISA (when I called) claims they peg their conversion to the WSJ rate. Total BS. They obviously charge the highest rate for the day, if not a little more, according to the numbers I got. Meanwhile, the Mastercard conversion calculator consistently charged the actual WSJ rate, if not the lowest rate of that day at any given minute. Lesson learned, I will be paying foreign partners with a Citi Mastercard with no foreign transaction fees. Amex is never accepted.

Thanks for the data point. Were you referring to the WSJ rate as of the transaction date or the post date? Also, what’s the nature of your purchase? Was it a single purchase of $4,500 or did you have a lot of purchases combining to $4,500?

I once did some homework on this subject, it seems like Visa will bill you for the exchange rate of the day of the purchase, they take the risk that the rate will change for the worse (or perhaps for the better) when it finally posts, but for that risk they charge a tiny premium, on the other hand MasterCard will charge the rate of the day of posting, therefore even if you see in your pending charges a amount in USD it might change once it posts, therefore they take less of a risk so their rate might be lower sometimes, but might be higher if the currency you charged goes up.

I guess that’s also the reason that on the MasterCard Currency Conversion Calculator web site you wont see today’s rate, you will only see up to yesterdays date, while on Visas web site you will see today’s rate, I believe its that customers shouldn’t complain that they had a cheaper rate on the web site than was actually charged.

Thanks for the note, Scot. I’ve read that theory before, too, but haven’t been able to quite reconcile. Did some experiment and wrote a follow-up post, if you’re interested: http://hungryforpoints.boardingarea.com/2016/09/foreign-exchange-deeper-dive