Churn The Alaska Airlines BofA Credit Card And Save Big With Multiple Companion Passes

As I wrote about previously, this year I’ve switched my primary airline from United to Alaska Airlines. My experiences so far this year with Alaska have been overwhelmingly positive, and I haven’t looked back. I have been trying to quickly build my Alaska mileage balance, and in addition to flying and purchasing miles, signing up for the Alaska Airlines credit card from Bank of America has been a huge help.

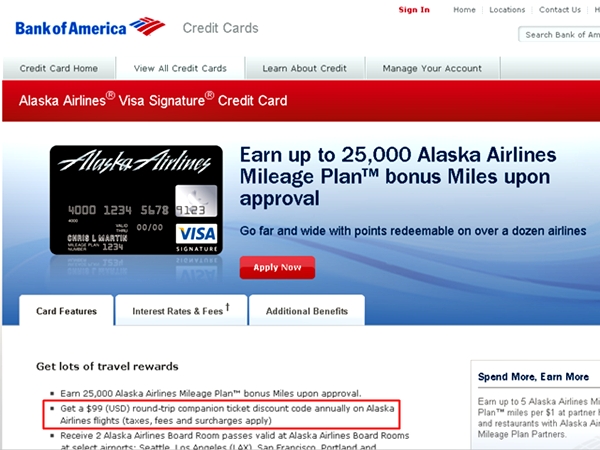

The offer on the Bank of America website is for 25,000 miles after 1st purchase with a $75 annual fee that is not waived. The card also comes with the following benefits:

- Earn 25,000 Alaska Airlines Mileage Plan™ Bonus Miles upon approval.

- Coach Companion Fare every year from $118(USD) ($99, plus taxes and fees, from $19).

- Earn 1 mile per $1 on all purchases

- Earn 3 miles per $1 on Alaska Airlines tickets, Vacation packages, and Cargo purchases

- Earn up to 5 miles per $1 at partner hotels and restaurants

- Enjoy no mileage cap. There’s no limit to the number of miles you can earn with the Alaska Airlines Visa Signature card.

- Go far and wide with miles redeemable on over a dozen airlines. Visit the Alaska Airlines website for the airline partner list.

This thread over on Flyertalk has a lot of good information, including more lucrative sign-up offers:

- 25,000 miles after 1st purchase, $75 annual fee but $100 statement credit after $1,000 spend in 3 months

- 30,000 miles after 1st purchase, $75 annual fee

- 40,000 mile offer after $10K spend in 6 months, $75 annual fee

While the bonus miles are great, the one benefit that has saved me a ton of money is the annual Coach Companion Fare, which allows you to add a companion on any Economy Class booking for just $118. Unlike most companion tickets, this one even allows you to earn EQM and RDM’s on the companion ticket.

Best of all, the Bank of America cards are churnable, meaning that you can apply for multiple personal and business versions. While there isn’t a specific or published time to wait between applications, reports on Flyertalk indicate that you can do so as often as every 3-4 months. Depending on your ability to manufacture spend, the various offers will appeal differently to each person, and personally I’ve found the 25,000 offer after 1st purchase and $100 statement credit to work best for my spending patterns.

According to the T&C’s, you can even use multiple companion passes when planning travel for a large group, since it states that the owner of the Companion Fare code but be either one of the travelers on the reservation, or can be the one that purchases the reservation for two other people.

Who can use my Companion Fare Discount Code?

The Mileage Plan™ member who owns the Companion Fare Discount Code must either be one of the travelers or the purchaser of the reservation. If the member is allowing two travelers to use his or her Companion Fare Discount Code, then the member’s name must match the name on the credit card used to purchase the reservation.

This is how I was able to use multiple companion passes on a booking for a family trip later this year, where instead of having to purchase 6 tickets, I purchased 3 tickets + 3 companion passes. Each of those companion passes saved over $500, which brought my total savings to over $1,500. Since the cost of the companion ticket is fixed, it makes sense to use them during times when fares will be highest such as holidays, peak seasons, and for last-minute travel.

Have you had success churning the BofA Alaska Airlines Card? What have you used your Companion Pass tickets for and how much money did you save as a result?

Applied for a second card; but got the platinum plus. Will cancel. FICO around 800

Interesting…how long between applications?

I apply for a second card every 90 days, cancelling my second Alaska Air card no less than 2 weeks prior to second card opening. Got 25K miles each time, done it 4 times in the last 12 mos; FICO score about 750. BTW, the 25K mile bonus posts to the freq flyer acct upon credit card account APPROVAL, NOT when you spend any money at all! The $1K spend is only required to get the $100 credit, for those that applied under that offer. I generally get the 25K bonus miles 5 -7 days after application ofr new account. No waiting for statement to post, etc. If some one needs miles FAST for a trip this is THE best way, in my opinion

Thanks for the data point, confirms that this card is very, very churnable. 25k bonus doesn’t excite a lot of people, but considering the churnability, low minimum spend and companion pass, this is an amazing offer.

I’ve read that you have to apply with different mileage account #s and then combine them later on? That seems like a lot of work. Is that true? Or can you apply for the same cards with the same mileage number?

I’ve successfully done this with the same exact account #. As always, YMMV but it’s certainly possible.