The Math Behind My Singapore Airlines Award Redemption To Singapore and India

In case you hadn’t realized, I’m a math nerd (as are some of my coworkers). That means that numbers weigh heavily into any decision I make around getting the best value out of my miles. In fact, I even built a model that tells me when it makes sense to use miles or spend cash for a specific ticket.

For my upcoming trip to India, I dusted off the model to compare a few different options. Here was the situation.

Flying to India with a stopover in Singapore

In this particular case, I had already narrowed down the focus of my analysis to the specific airline and frequent flyer program that I was going to use for my redemption, which was Singapore Airlines in both cases. And en route to India, I had already decided that I wanted to make a 4-day stopover in Singapore.

To get to India from the US on Singapore Airlines, you need to connect through Singapore. But since Singapore and India are in 2 different regions, it means that the Singapore-India flight essentially kicks you into a higher redemption bucket. As Lucky had summarized, Singapore Airlines actually allows you to pay $100 to add a stopover, even on one-way Saver tickets.

So that presented three options for my desired First Class itinerary:

- West Coast US – Singapore: 107,500 (91,375 after 15% online discount) +$263 surcharges + Singapore – India: 35,000 (29,750 after 15% online discount) +$145 surcharges= 121,125 total miles + $408

- West Coast US – Singapore: 107,500 (91,375 after 15% online discount) + $263 surcharges + Singapore – India: cash booking: 91,375 total miles + $566 ($303 economy ticket + $263 surcharges) or $1,261 ($998 business ticket + $263 surcharges)

- West Coast US – India: 125,000 (106,250 after 15% online discount) + $376 surcharges + $100 stopover fee = 106,250 total miles + $476

Which one is the best option? Well, it’s hard to tell just by looking at them. Let’s run the numbers.

Use miles or pay cash?

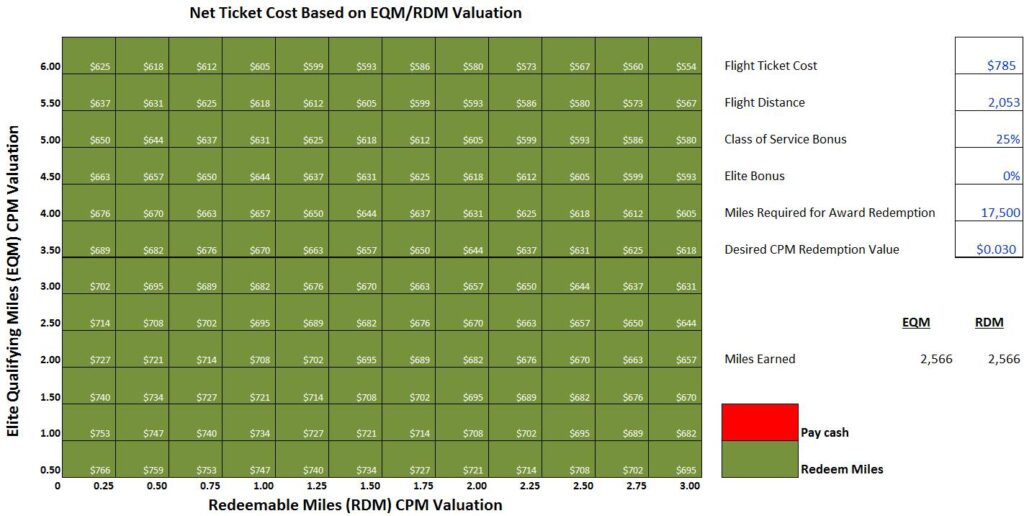

Just by eyeballing the options above, #1 clearly looks worse than option #3. Essentially, you’d be spending 14,875 miles to save $68 which values your miles at just a 1/2 cent a piece. So really this comparison boils down to option #2 vs. #3. For now, let’s compare the Business Class version of #2 since that is identical to what I’d be flying in option #3 to Hyderabad which is only operated by a 2-cabin plane. The incremental cost between them essentially boils down to 14,875 miles or $785, or a valuation of 5.3 cents per mile.

The choice is clearly illustrated when punching these figures into the model:

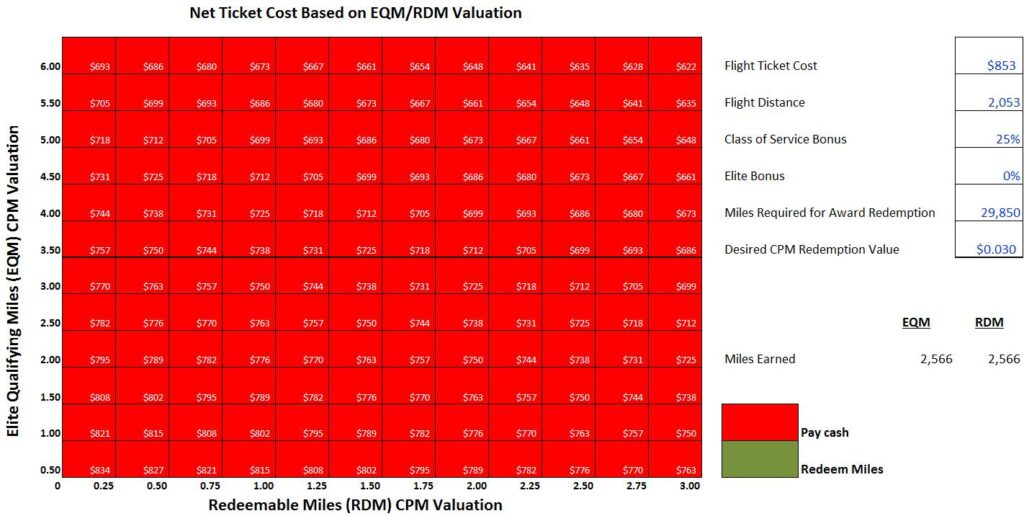

Even though we had eliminated option #1 from the beginning, it’s interesting to compare it to option #2. If that were truly the comparison, the choice to pay cash or redeem miles would be flipped from the choice above.

The final decision

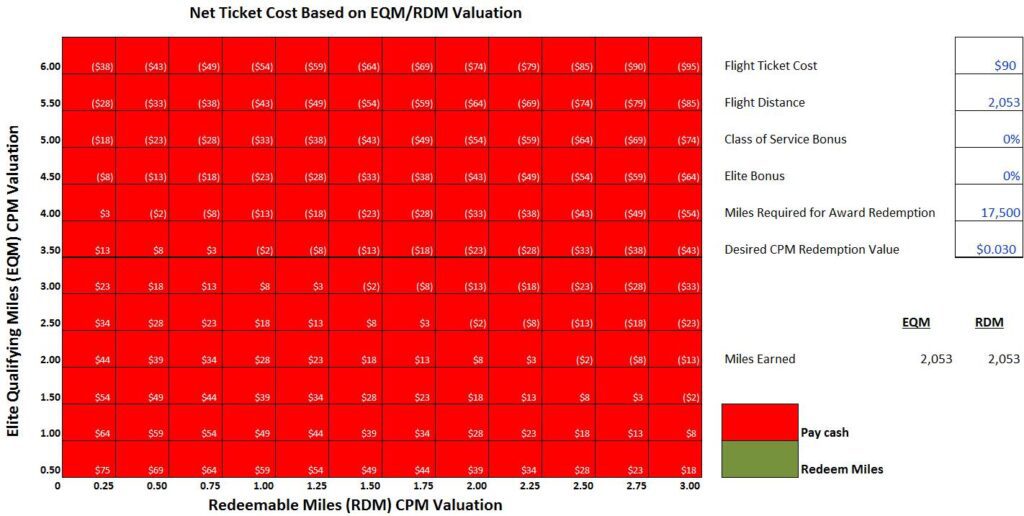

So what did I actually do? I booked a cash economy ticket from Singapore to India, which saved me 14,875 miles in exchange for $90.

Now, I’m fully aware that I’m mixing apples and oranges to some extent since the mileage redemption would have granted me access to a Business Class flight, but you can think of this situation as one where you’ve booked a premium cabin award that only has economy available for the final short leg.

The decision to pay cash for that ticket was a no-brainer, as shown in the graph below. In fact, while I don’t value the EQM’s at all since my primary program is Alaska Airlines, accounting for the redeemable miles bring the net cost of this flight down under $25.

I’m curious, what would you have done if you were in a similar situation?