My Oldest Credit Card Just Got The Axe

It’s the credit card equivalent of getting a text from your significant other with the message “Need to talk to you right now, really important call right away!!!”. While that conversation usually turns out to be a false alarm, along the lines of them being at the store and not remembering if you were out of milk, Citi wasn’t messing around.

I logged into my account, anxious to find out which of my 4 Citi credit cards had gotten the axe. Of all the ones I didn’t want it to happen to, of course that was the victim.

Why was my card closed

My Citi ThankYou Preferred card, the oldest of my entire collection of credit cards which I’ve had for nearly 15 years, died today, on November 17th, 2014.

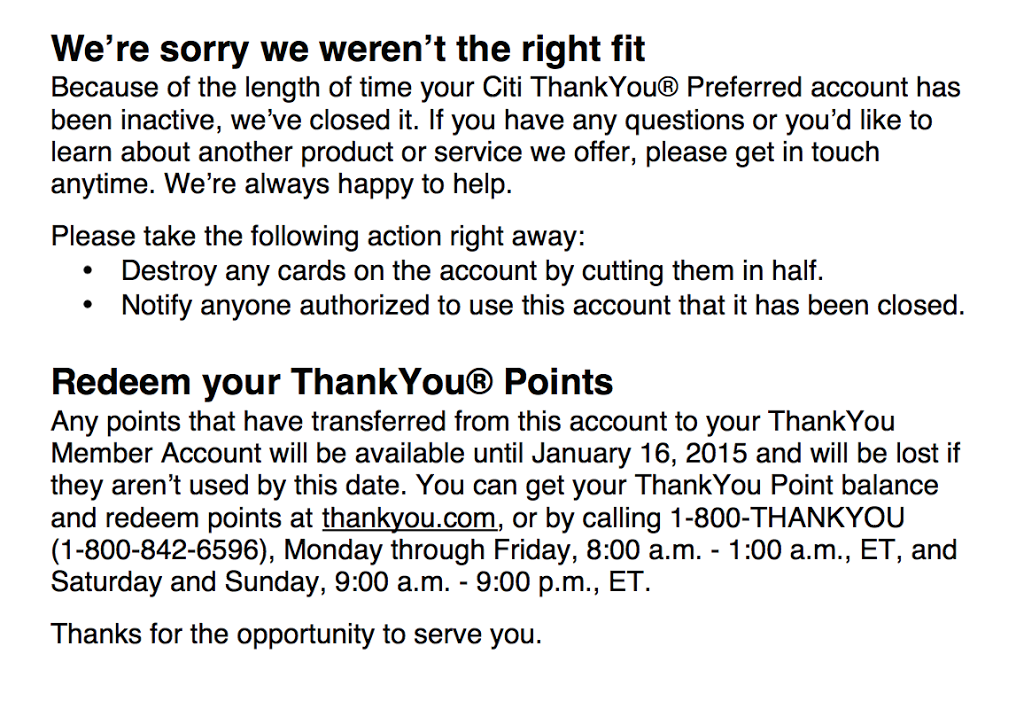

A short and sweet message from Citi indicates that it was due to lack of activity, which is fair since I haven’t used that card in several years.

So if I wasn’t using the card at all, why am I so sad about the account closure?

FICO credit scores take into account your average length of credit history, and with all the churning that many of us do, it means that the majority of our credit cards don’t even stay open for a year. While those closed accounts stay on your credit report for up to 10 years, it’s a good idea to preserve a good average length of credit history by keeping a few no-annual fee credit cards in your sock drawer.

As an added bonus, American Express back-dates all new cards to your oldest credit card’s date, which for me is about 10 years ago. So even if I opened a new Amex card tomorrow, it would count as 10 years old.

I have multiple credit cards that are just sitting around unused, and never had a problem until now. But this closure coincides with recent news that many of the old American Express Blue Cash cards were getting closed, and could be an indication that the card issuers are cracking down on inactivity.

My favorite memory of the card

As part of the eulogy for my oldest card, let’s flash back to 2008. My friends and I decided to take a trip to Thailand, and I unwittingly lucked into being the one who booked all 4 tickets for the group on my Citi Preferred card.

Why did that matter? Back then, this card actually provided 1 point per flight mile on all airline tickets purchased with the card. Which meant that in addition to the 1x I’d earn on the cost of the tickets, I also earned 1x flight miles for each of the 4 airline tickets, which brought in nearly 70,000 points for the trip!

As ashamed as I am to admit it now, back then I was as unsavvy and clueless about points and miles as one can be. But that didn’t change the fact that I was ecstatic about the points windfall, and did what a typical 25 year old would have done – I cashed them in for a $700 statement credit! Can you blame me? That’s a LOT of pizza and beer!

I had a Lowes and Home Depot card (from before I was more credit card savvy). Recently looking at my credit report I saw both had been closed by the issuer (with a note “always paid on time” or something like it). They didn’t send a word about it. I didn’t try to log on, and am not sure I would have remembered the logon/pw.

I think store cards get closed more easily without formal warnings. They probably just assume that their holders forgot about them.

A number of years ago I had a real credit card (Chase) being closed like you described, Terence. Back then I didn’t even know to care. Figured that having two credit cards was all that I’d ever needed. With that experience now I feel rather paranoid trying to manage my portfolio of cards that I want to keep. How much spend I need to put on a card and in what frequency is something that I have no clue about. Say, would Citi still decide to close my card if all I use it for is a cup of Slurpee once a year? I assume there’s no set formula for this.

It sounds like all the card issuers (Citi, Chase, Amex) are cracking down on inactivity. I’ve heard that all it takes is 1 transaction during the 3-year renewal cycle in order to keep the card open. Even a slurpee or cup of coffee would do the trick.

If you don’t have any activity, then your card won’t be renewed.