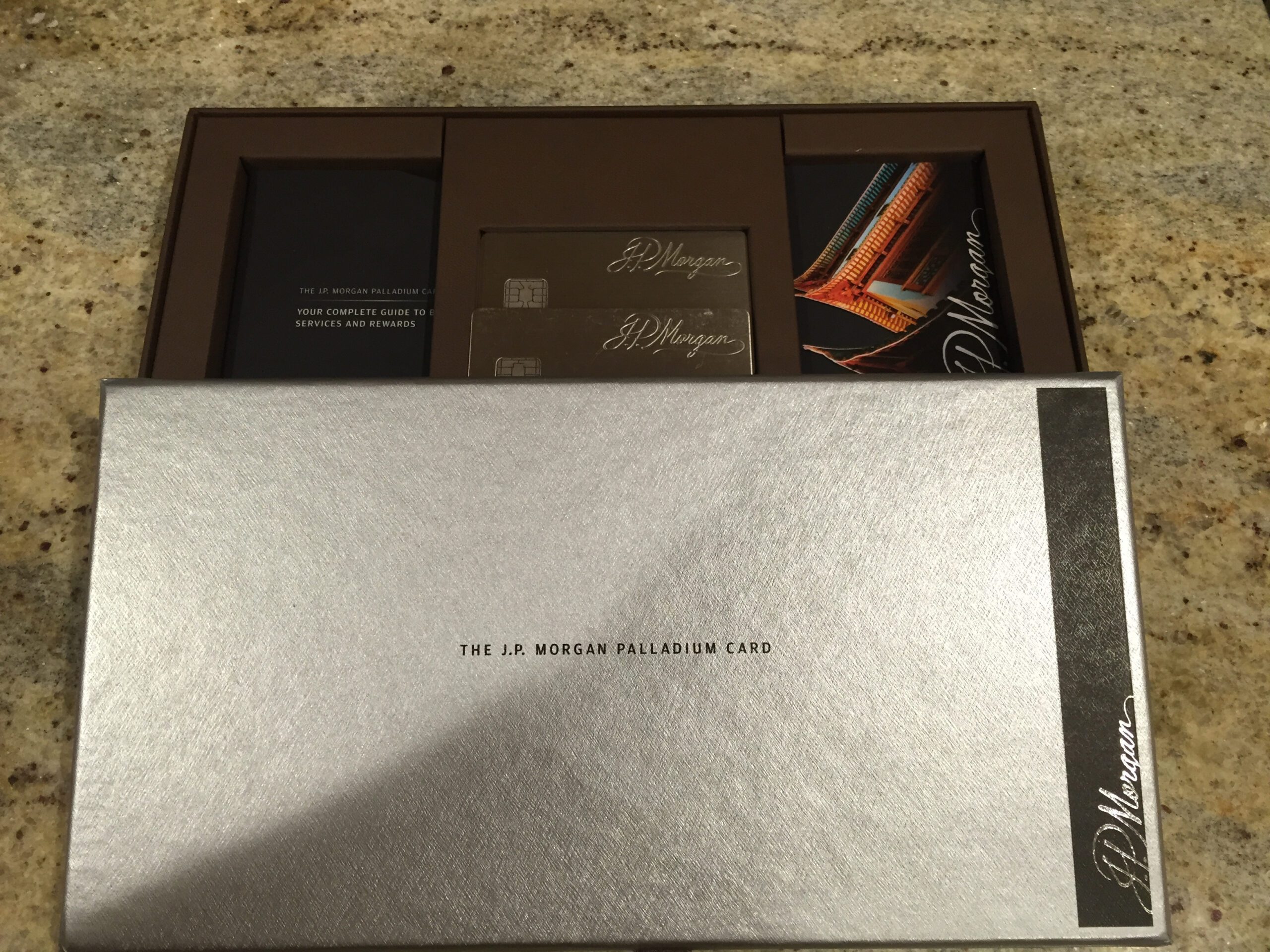

Saying Goodbye To The JPMorgan Palladium Card

It’s a process that I go through every year for each of my credit cards – the annual retention call. I throw on my most innocent sounding voice, and call the number on the back of the card.

“Hello, I just noticed that the annual fee was billed and I’d like to cancel my credit card.”

That sentence usually triggers a “WAIT STOP!” type of response from the customer service representative, and a couple minutes later I’m walking away with some free points or a statement credit.

In most cases I’m fishing for free stuff rather than actually trying to cancel my credit card, but last week I called the number on the back of my JPMorgan Palladium card with the intent to actually cancel the card. After my opening line, the representative followed up with a “sure, please confirm that you’d like to cancel your account” and 30 seconds later it was done.

I guess that’s a fitting end to my 3-year run with the Palladium card, which at a $600 annual fee is probably one of the most over-hyped cards out there. Yes, it does have some benefits such as a full United Club membership, unlimited Lounge Club membership, and 35,000 bonus points after $100,000 spend, but in my experience they haven’t justified the high annual fee. Some people may value the hidden credit line, enhanced purchase protection, and primary car rental insurance, but those are all things you can find with other cards with much lower annual fees.

For me, admittedly the main reason I applied for the card several years ago was for the wallet bling. There’s no denying that this card looks damn cool and carries with it a certain amount of exclusivity.

And the only reason I’d kept the card this long was due to FOMO, or fear of missing out, because while I had applied for the card several years ago using a loophole that allowed anyone to apply, today the only way you can get the card is through a relationship as a Chase Private Client. So with rumors swirling that there would be great enhancements made to the card, I didn’t want to risk canceling it and not being able to get it back, if something amazing was indeed added.

But for the most part, the long-awaited enhancements to this card just never came, and I’m convinced that they just aren’t coming. It will be interesting to see what JPMorgan’s strategy ultimately is for this card since it certainly doesn’t have enough benefits or perks to keep up with the American Express Centurion card, and frankly not even the Amex Platinum card.

For now, I’m happily done with the card, and the spot in my wallet has already been filled. I guess the only question that remains is how the heck to destroy it?

The card looks really nice, but I agree it’s not worth the $600 AF. The Centurion card isn’t worth the fees either. Sad that the best credit cards to hold onto nowadays for benefits cost $0-450.

I agree, the ultra-premium cards really don’t seem like they are worth it. I’m more than happy with Amex Plat + Chase CSP

When I called to cancel my Avianca card, the rep’s immediate response was “Done! What else do you want?”

How do you say “retention department” in Spanish?

Other than the bonus at 100K, what are the benefits of this card over Chase Sapphire preferred? You listed the lounge access, but for the cost of this card you could get an Amex Platinum and a CSP!

There isn’t much, which is why the $600 fee is so outrageous. The only other benefits over CSP other than lounge access are hidden credit line, primary car rental insurance, and higher limits on purchase protection. I’ve also random gifts from time to time, which have had a value of a couple hundred dollars each.

The CSP offers primary rental insurance too.

Good for you!

I keep a collection of my cancelled or expired metal cards. Palladium makes a nice souvenir but if you really want to destroy, Chase will send a return envelope.

I cancelled also.

This card also doesn’t charge you fees when you spend in foreign currency. For those who travel a lot, it’s definitely a good thing. My old Chase Freedom was charging me 3%…

The reason why they just closed your account is because you did not spend on it, and if you use it the way it’s intended it’s an extremely valuable card. $600 a year is a small price to pay for the amazing perks outside the membership book. I use it and it gains me celebrity status to a point and I get upgrades without asking. How do I know? I stay at hotels 90% of the year. I used my Amex Plat most of the time for the past 2 years one upgrade out of the blue. But I have used my palladium and I am batting .700 easy. I just show my card and let her do the talking. so yes its worth it and $600 is nothing when you’re paying that for dinners.

Dear Terry,

If you really have one of those cards, can you tell me what that is like? I am a broke college student with student loans galore. I’ve only ever worked at a grocery store and made 300 bucks a week. What type of business are you in? Can you teach me how to invest so I can become one of those card holders too? What’s it like to have one of these cards?

It’s nice to have any card which is unique enough to draw attention. I’m not sure it draws upgrades as typically the upgrades seem processed before I arrive with American Express or Starwood Platinum membership, but everyone loves a bit of attention. I own a business like most people with a collection of cards. Often people with these types of cards do because even a very wealthy doctor or lawyer won’t have the $1,000,000 plus spend that some of these folks do. But, if you have a business and buy things for the business, well, the spend comes pretty quickly as there are always things to buy — inventory, materials, or just paying the water bill(s).

Want account