Do Your Taxes Now

Ides of March marks the approximate midpoint between when most of us received our last 1099, and when the dreaded income tax returns are due to the IRS. If you have not done so already, this is a great time to open your 1040 booklet PDF or install the tax software of your choice.

The only reason we talk about income tax on Hungry for Points is, in the event that you owe Uncle Sam money, you can pay it with a credit card and earn points. This is no news. But if you, like me, had dismissed this option years ago and have not paid attention to it since, do note that:

- The convenience fees have dropped, from around 2.5% in the early days to as low as 1.87% on pay1040.com

- The credit card market now has a number of products that give 2% or more in cash back on any spend

If you don’t owe Uncle Sam money, do kindly ignore all these logos

The first card that comes to mind is Discover IT Miles. This card normally pays 1.5 “miles” per dollar of purchases, which is basically a 1.5% cash back. If you are enrolled in Discover’s 12-month double cash back promotion, you would expect another 1.5% at the end of it. Therefore, you can manage to get 3.0% in total cash back. When hit with a < 2% convenience upon paying your federal income tax, the expected return is > 1% of the total amount.

Apparently not every tax filing software’s E-File functionality works with pay1040.com. Some are locked into using a different credit card processor, that charge a higher fee, while the software company gets a kick back in commissions. In my case, H&R Block uses payUSAtax.com with a 1.99% fee, although there are scattered reports of users calling technical support and getting workaround to use the cheaper option.

Of course, nobody will get rich on the ~1% cash back difference on their income tax liability. Paying taxes with a credit card is far more valuable when it helps you meet the minimum spend of a new card and earn the sign-on bonus that you may otherwise struggle with. Suppose you have a brand-new Chase Ink Plus, and that you happen to owe $5,000 in tax. Charging it will cost ~$100 in fees (at 2%), and earn you ~65,100 in points (sign-on bonus plus points earned on the purchase). Those points are worth a minimum of $651 if you redeem them for cash, and much more (e.g. $1,300) if you use them for travel. Wherever your preference lands on that spectrum, it’d be a huge arbitrage against the fees that you have to pay.

Being able to pay income tax with a credit card is nothing new. However, it may be more relevant this tax season than ever before. Two reasons:

- With the rumored 5/24 rule apocalypse coming to Chase’s co-branded cards in April, you may be applying for more cards (and therefore facing a higher minimum spend requirement) than you otherwise would.

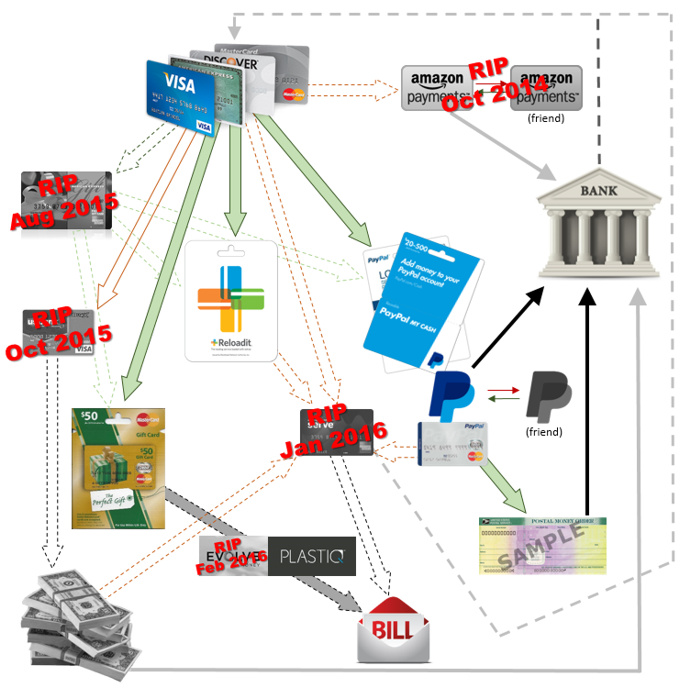

- Manufactured spending techniques have dried up in batches recently, and some of us started resorting to costlier alternatives. The <2% fee on income tax payments is good compared to the 2.5% levied by services like Plastiq, which allow you to pay bills with credit cards.

Can you tell that I got a lot of time back on my hands?

Getting your taxes done now is important because you need to know out how much you owe (if any), then get the right credit card based on how much you can “afford” to spend. With a month to go before April 15, the bank should have enough time to ship that card to you before Uncle Sam comes knocking.

BOTTOM LINE

Income tax is an expense that applies to everyone, is potentially large, and can be precisely determined far in advance of it needing to be paid. Properly taking advantage of this annual ritual will hopefully lessen the pain of paying taxes a little.

Don’t forget to go through a shopping portal to download your tax software. For example, I use H&R Block and got 8 AA miles per $ on the price.

Are you on hiatus? Haven’t seen a new post in a while.