A Math Nerd’s Quest to Become A Points & Miles Millionaire – Manufactured Spending

This is part three of A Math Nerd’s Quest to Become A Points & Miles Millionaire.

- Introduction

- An Accounting Exercise

- Manufactured Spending

- Status & Perks

- Why Stop at Miles and Points?

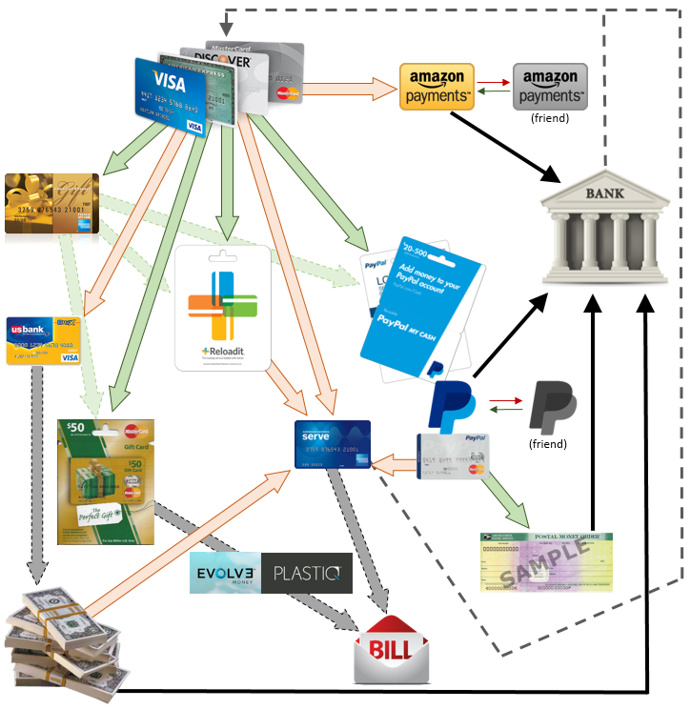

Manufactured Spending (MS) is a big part of the points and miles hobby. It’s a collection of techniques where you pretend to spend the money that you don’t have, in order to generate points. The general concept is that you buy cash-equivalent instruments with a reward-earning credit card, and then convert those instruments to cash in order to pay off the credit card balance. I illustrate below the techniques that I have used within the past year:

Everything becomes easier to understand with a flow chart… right?

Like my other posts, this article is only meant to share my learning experiences. If you are looking for a how-to guide, a quick Google search will land you on dozens of relevant websites within the travel hacking community. In particular, Doctor of Credit and Frequent Miler are two blogs that I follow and provide MS-related updates. Don’t be alarmed if it seems overwhelming, though. MS is quite complicated and can take a while to get used to. If bank accounts and credit cards are already more math than you care to do, you might want to skip the rest of this article.

THE BASICS

Let’s look at a completely hypothetical example… I go to a local pharmacy and buy two PayPal My Cash cards, loading $500 on each. With the $3.95 fee that comes with each card, I pay $1,007.90. Assuming my credit card gives 1% cash back, the rewards are worth $10.08. After loading the funds onto my PayPal account, I use the PayPal Business MasterCard to buy a $998.35 postal money order at the Post Office. With the standard $1.65 fee for postal money orders, I completely use up or “unload” the funds. Next, the money order gets deposited into the bank, completing the cycle.

The total expense here is the difference between my purchase price ($1,007.90) and the cash amount that end in my bank ($998.35), namely $9.55. Since my earning exceeds this amount, I’ve just made a profit. A whopping $0.53 profit! Yay?

It is rather difficult to accumulate wealth when so much trouble earns me only two quarters. However, the math could look different if I were accumulating miles toward a specific trip – $9.55 is a great deal for 1,008 miles if I otherwise have to pay the airline loyalty program $35+ for them. It’s also possible that I can use a credit card that earns 5% at the particular store, in which case my profit jumps up to $40.85… and actually makes my time worthwhile.

However, even low-yielding MS techniques can themselves be useful. An important use is to meet credit card minimum spending requirements. I recall getting Chase Sapphire Preferred and stressing out about needing to spend $3,000 on it within three months. Not everyone can afford to actually “spend” $1,000 every month! With the example above, even though the profit was minimal, I have just put over $1,000 on the card. Do it two more times and, bang, I’d qualify for the sign-on bonus. Thanks to MS, I no longer hesitate to apply for credit cards with high spending requirements. Last summer, I was able to put $10,000 on my Citi AAdvantage Executive within a single month, moving me a big step closer to my points & miles goal.

A CONSTANTLY EVOLVING HOBBY

Some people love to bring up how, back in the days, the US Mint allowed people to purchase dollar coins online with a credit card. With no fees, taxes, or a shipping charge, that was the purest and the most straightforward form of MS. People racked up huge rewards at the expense of other American currency holders (since they effectively bought the dollars at a discount), and it must have been a sight when they carried thousands of dollar coins to the bank for deposit. Obviously, that was not sustainable. The government labeled the practice as a “scam” and stopped allowing credit cards for coin purchases.

Like the Baskin-Robbins Free Cone Days, free things are great but don’t expect them to last long. In fact, I have only learned about MS for a little over a year, and four of the opportunities that I picked up (parts of the diagram above) are already gone. To me, this is the most “expensive” aspect of the MS hobby. It takes a lot of effort to explore opportunities, learn about them, experiment, and eventually become comfortable with each technique. When a product or program shuts down, all that investment of time and effort loses value. New opportunities do arise, but it will be a learning process all over again.

RISKS

I don’t know about you, but I have never been a cash person. For the majority of my life, having more than $100 in my wallet would make me uncomfortable. Why do I need it on me? What if I lose my wallet? What if I get robbed?

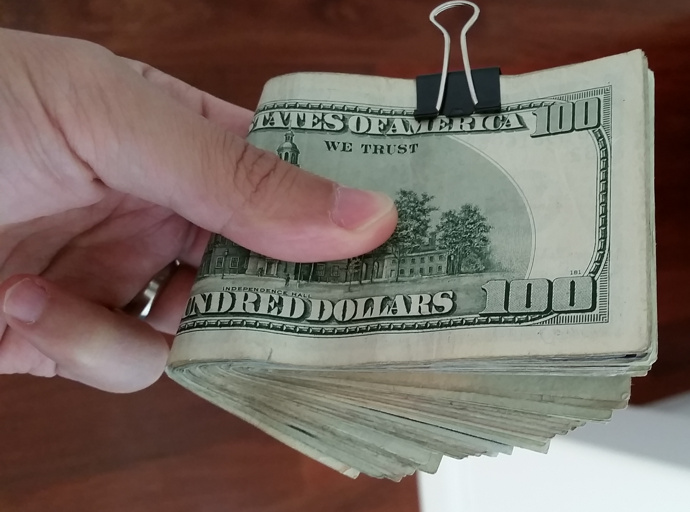

Getting into the MS hobby was a serious challenge to that mentality, since it regularly involved taking large sums from one place to another: it could be a $2,000 gift card, a $950 money order, or a big handful of legal tender. No matter how used to having them in the pocket you become, there is always a risk of losing them at one point or another.

Unlike credit cards, this paper currency does not come with theft protection

A more commonly discussed risk is getting your hands slapped by the institutions. Since most of the MS instruments are not designed to help people profit on points and miles, the banks, gift card issuers, stores, etc may get unhappy with your activities and shut you out. Many people have experience with suspended prepaid accounts, having funds locked up for months at a time. Losing access to that money and losing access to the MS opportunity can both cause major headaches.

I got into this hobby when Amazon Payments was the hottest topic in the community. The service allowed individuals to send, by using a credit card, up to $1,000 per month to other individuals. That MS opportunity was, except for its low limit, easier than buying cash with a credit card. However, Amazon reportedly shut down a lot of people’s accounts when it identified them as merely exchanging money between two people (therefore not making real “payments” as the service was designed to do). I didn’t want to get shut down, so I aimed to set up a scheme that looked natural. We ended up with eight friends and families, sending randomized amounts to one another in a complex web, that also ensured each person always transacted just under $1,000 per direction per month. We celebrated the genius setup, and thought we could do this forever and remain under the radar. Unfortunately, the entire Amazon Payments service was discontinued shortly after.

Part of a rather convoluted Excel workbook detailing who should send who how much money

Admittedly, we probably spent all that effort for nothing, but I see the conservative approach as a reflection on the risks that the particular MS activity involved. While I am far more “at ease” with the various MS techniques now, I am still conscious about how much money such activities cycle through and what messing up could mean.

FRUSTRATIONS

I love MS because it embraces a key aspect of capitalism – that in the free market, people empowered with knowledge can take advantage of what they know in creative ways and come out ahead of others. But let’s not sugar coat this hobby… it is a shady practice. Honestly – who goes into the same store four times a week, buying a $500 gift card each time? MS hobbyists and criminals. When the cashier looks at me suspiciously, I really don’t blame him/her for wondering if I am holding a stolen credit card. The steps we take to convert credit card purchases into cash are the same steps a person could take to launder money.

As such, playing this game means dealing with some purchase denials, having to show ID randomly, and responding to a lot of texts and calls from the credit cards’ fraud warning department. None of them was a big deal, but still can get tiring at times. Some people who are far more ambitious in this game have reportedly seen mandatory financial reviews, IRS audits, account closures, and funds being frozen. I hope to never experience those myself.

Another thing is that MS takes time. I consider myself to have fairly good organizational skills, so this hobby isn’t as much a chore as it may seem to some other people. Nevertheless, on top of the two dozen active credit cards, managing a handful of prepaid debit accounts and various online logins could add to the stress.

INDIRECT BENEFITS

I get more exercise now than a year ago, and my knowledge of local geography has improved. How many people can say that they know the exact locations of 14 Walgreens, 8 Safeways, and 4 Post Offices? In the MS hobby, exploration is often necessary in order to learn about which stores carry a certain product, and whether they would let you buy it with a credit card. This could be annoying in the suburbs since it involves a lot of getting in a car, burning gas, being stuck in traffic, and finding parking. Since I work in a city, I get to walk everywhere. MS becomes my excuse to off-board the train one or two stops early, and stroll speed walk through the city during my commute. If anything, my greed has made me a healthier person.

In a weird way, this hobby has also made me a friendlier person. While I generally prefer putting on my New Yorker face in public, it gets awkward to walk into the same stores every other morning looking like that. I started smiling to the cashiers, saying hi, and sometimes even ask how they are doing. In return, several of them recognize me as a frequent customer and would welcome my visit, as well as speed up my purchase: “Five hundred dollars again, right? No problem…” Well, doesn’t hurt to see some friendly faces first thing on a weekday morning!

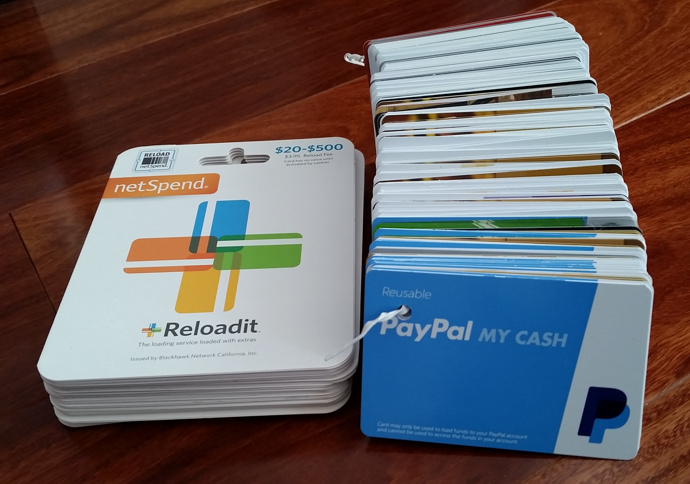

A year worth of MS. Several cashiers thought I was a really generous gifting friends $500 at a time

DIRECT BENEFITS

Manufactured spending has played a major role in my points & miles millionaire achievement. A back-of-envelop estimate yields that, without this sub-hobby that I picked up last year, I would have earned 180k fewer points from credit card charges, and missed out on ~350k points in sign-on bonuses due to being unable to meet certain minimum spending requirements. Sure, I will eventually racked up those half million points using less aggressive methods, but that would require a lot more patience!

With gift cards and reloadable debit cards, my monthly credit card bills more than tripled

Manufactured spending means different things to different people. Some (though very few) allegedly can sustain a living on MS alone, while a couple of prominent bloggers in the points & miles hobby claim to never touch these activities. Depending on which opportunities are available to you and how much you value your time, whether MS is worthwhile is often borderline. It’s exciting to pull off these mini arbitrages, but it’s also a lot of work. Considering the risks and frustrations involved, I have no idea whether I will continue to MS another year later. No sweat, though. It’s a hobby, not a second job. I appreciate the benefits that I have been able to reap, and I’ve had fun in the process.

Funny take on this.

Glad to entertain!

USPS takes credit cards for money orders?

It doesn’t. But debit cards work.

1. How much, in USD, do you value a hour of your time when doing this?

2. Isn’t the ‘hobby’ the actual travelling part and not standing in line at drugstores?! I think people convince themselves that the latter is the hobby in order to justify doing it

1. Not much, but slightly more than an hour watching TV or reading political debates on Facebook.

2. There have been times when I realized certain activities were a complete waste of time, and I’d later change what I do. Though I don’t try very hard to “justify” MS because I don’t see it as an economic activity (i.e. a second job). It’s not for everyone, for sure.

As a side note, anything can be a hobby if mooing can be a hobby: http://www.metroparentmagazine.com/events/125908013.html

That’s a lot of paypal. You haven’t had issues with them loading all of that into your account(s)?

That’s a great question, and an important one. Short answer is no, and I’m probably just lucky. I have read about and know people who’ve encountered problems with PayPal and are hesitant to ever touch it again for MS (and this is what my Risks section mainly referred to). Personally, I take precautions such as never going for the monthly load limit, never withdrawing funds directly to bank, and occasionally mixing in real purchases from my PayPal accounts. Fingers crossed!

Hi, I’m just curious how the large pile of Starbucks cards fit into your MS strategy. Are you just purchasing them in an establishment where you can get 5x miles/5% cashback and actually use most of them to eat/drink at Starbucks? Or, is there some liquidation strategy where Starbucks cards can be turned into cash?

Thank you for your post, your thoughts are very helpful for someone who is trying to figure this out and has not really started yet. I really like how your article is organized clearly into different sections explaining the different sides/ways of thinking. Thank you.

Hi Lucky’s Reader – you are right in pointing out that those Starbucks cards (as well as the Amazon ones) are not real MS. The only way to unload them is to get a lot of coffee. I got them opportunistically for the 5x or better deals (i.e. Amex offers), but figured that they fit nicely into this picture.

LOVE the chart. Thank you for putting it into a nice visual for a beginner like me!

Somewhat of a related post here… TAXES! http://hungryforpoints.boardingarea.com/2016/03/do-your-taxes-now/

hi, thanks for your article i like how you divided it up and made it so clear for readers to understand.

What are the current ways up to date for manufactured spending?

Thanks for your feedback, mark. Unfortunately, I along with many other people have seen MS techniques dry up without finding replacements for any of the lost opportunities. My post on taxes (http://hungryforpoints.boardingarea.com/2016/03/do-your-taxes-now/) has an updated post on my flow chart.

Is there a reason you buy a new PayPal cash card each time instead of just reusing the same one that is already linked to your account?

No particular reason, other than laziness. Though I manage a few accounts and imagine keeping track of which blue card goes with which may get a bit confusing. Not a great excuse, I know.