My Unexpected Chase Sapphire Reserve Approval

I have been keeping a close eye on all the action this week with the release of the Chase Sapphire Reserve credit card and in particular, it’s been interesting to see all of the data points coming through on who has and hasn’t been getting approved as a result of Chase’s 5/24 rule. Since I was currently sitting at 7/24 (e.g. 7 new credit cards opened within the past 24 months), I made sure to do my homework on how to best maximize my chances of an approval, which would include a visit to my nearest Chase bank to apply for the card as opposed to doing so online.

The in-branch approval process

As a loyal Bank of America customer for the past 15+ years, if part of Chase’s strategy with the in-branch approvals is to get people in the door, then it certainly worked. Fortunately, there are plenty of Chase banks in the SF Bay Area, and I have branches within 5 minutes of both my work and home.

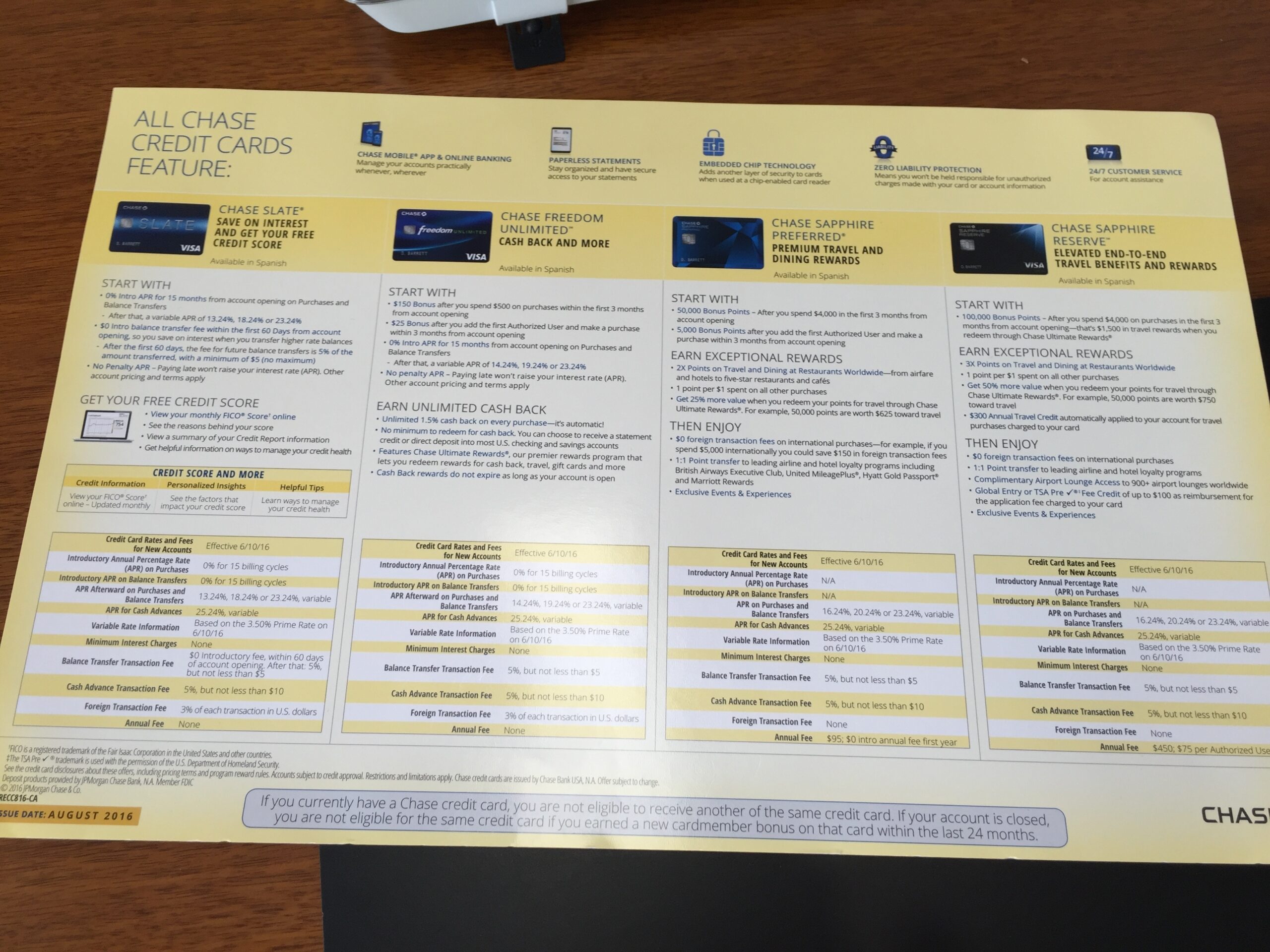

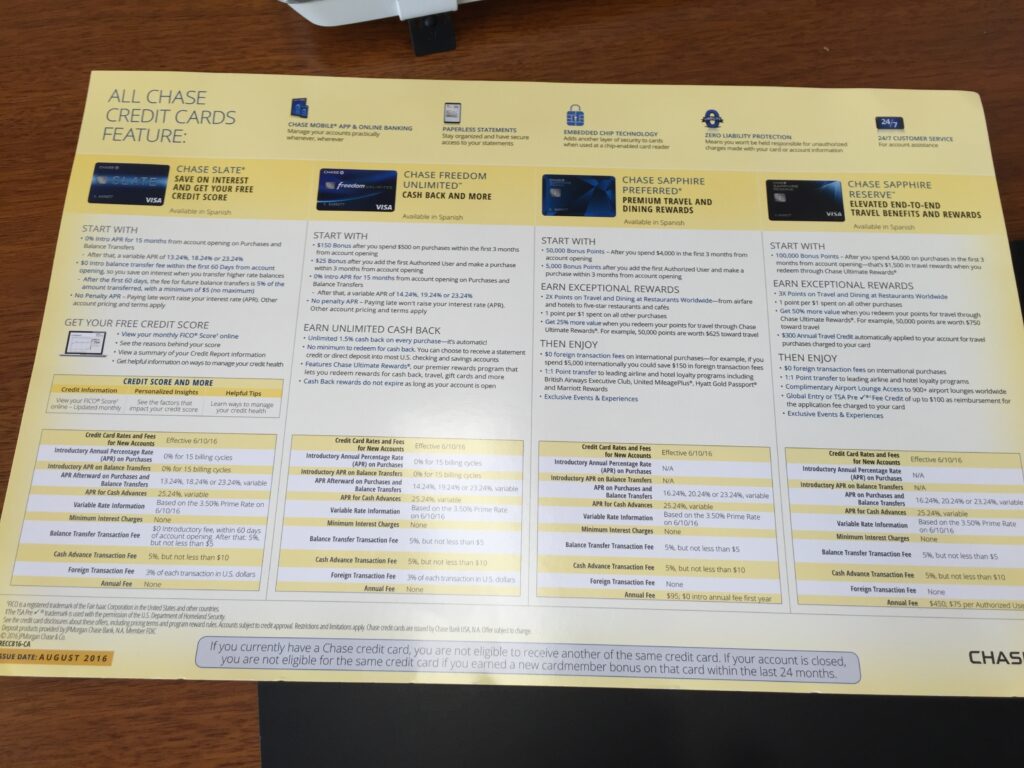

I figured that the first couple days may be hectic with all the “crazies” coming in, and decided to go in today. I was able to walk right up to an available banker who presented me with the menu of credit cards below. I didn’t have to review it for long, since I already knew exactly what I wanted.

Even though it’s been well-documented that there is currently a 100k sign-up bonus available for the Sapphire Reserve card, there’s always a bit of anxiety when the application doesn’t explicitly show the bonus amount. So it was nice to see the 100k bonus clearly stated on here.

After handing over my driver’s license and a current credit card, the banker pulled up my file and confirmed that I had been pre-approved. I had to answer a couple more questions, and seconds later I received the official approval! The process couldn’t have been easier, and I was in and out of the bank in about 5 minutes.

Why was I approved?

Since I was sitting at 7/24, I set my expectations low and was prepared for a denial, so of course was pleasantly surprised to be approved for the Sapphire Reserve card. Based on my data point it’s clear that there are exceptions to the 5/24 rule, but the black-box nature of the approval process makes it hard to pinpoint why I received an exception.

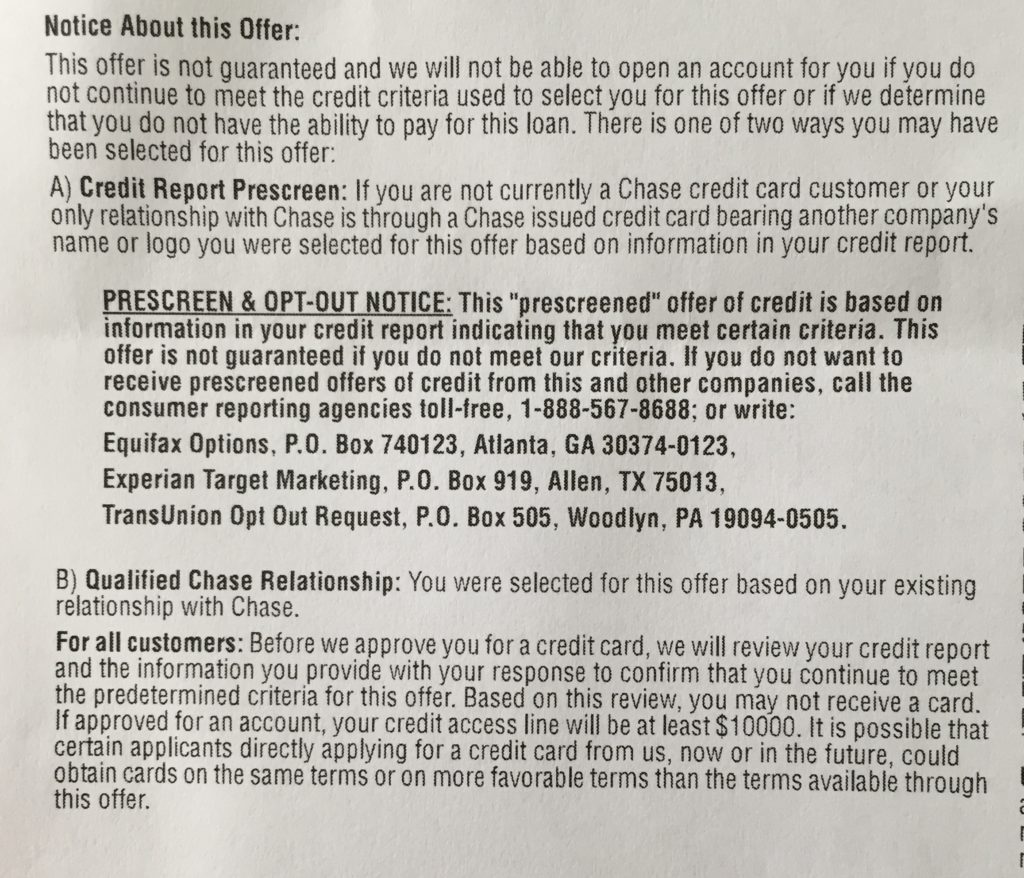

As I took a closer look at the application disclosure form, it looks like it really comes down to the paragraph at the bottom:

You were selected for this offer based on your existing relationship with Chase.

I currently do not have any banking relationship with Chase, nor am I a Chase Private Client (CPC), but I did have this going for me:

- While I’ve churned several Chase cards in the past (Hyatt, United, Marriott), I’m a long-time Sapphire Preferred customer and have paid annual fee 5+ times

- Currently have an auto loan with Chase, but no checking/savings or mortgage

- Lastly, not sure if this is a factor, but geographically I have Chase branches within minutes of my home and work locations

For others who have circumvented the 5/24 rule, any other factors that you think may have helped you get approved?

Congrats!

Hello,

Thanks very much for your blog.

I am curious about your and anyone’s input on the following re denied application for the CSR card:

Denied due to 9/24. Credit score 765. Income 120K.

Already have CSP, Mileage Explorer, and Freedom by Chase.

Will drop to 4/24 by Jan 2017. Will re-apply for CSR then.

Question:

Any insight whether closing the CSP (with a 50K credit line) would be an advantage?

Thanks – Mark

Hi Mark – thanks for the comment! Given that you only have 3 Chase cards, I think the underlying issue is 5/24 as opposed to too high of a credit line on the CSP. Probably not the answer you were hoping for, but I doubt closing that card would help.